|

ENSLAVEMENT & BANKRUPTCY OF |

|

CEDOMIL VUGRINCIC, M.D., Ph.D. |

|

Beloveds, global scheme of

Cabal's foreign owned and thus Constitutionally illegal Corp.U.S.

Government, in seeking the

world domination and control, always was, is and will be to "INDEBT,

BANKRUPT, ENSLAVE The below article describes

well the present, Cabal's Corp.U.S. Government

induced, economic reality facing the American people. http://www.financialsense.com/fsu/editorials/martenson/2006/1217.html

The That is the

conclusion of a recent Treasury/OMB report entitled Financial Report of

the United States Government that was quietly slipped out on a

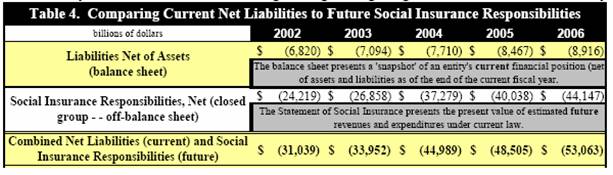

Friday ( But, hey, I understand. A report this bad requires all the muffling it can get. In his accompanying statement to the report, David Walker, Comptroller of the US, warmed up his audience by stating that the GAO had found so many significant material deficiencies in the government’s accounting systems that the GAO was “unable to express an opinion” on the financial statements. Ha ha! He really knows how to play an audience! In accounting parlance, that’s the same as telling your spouse “Our checkbook is such an out of control mess I can’t tell if we’re broke or rich!” The next time you have an unexplained rash of checking withdrawals from that fishing trip with your buddies, just tell her that you are “unable to express an opinion” and see how that flies. Let us know how it goes! Then Despite improvement

in both the fiscal year 2006 reported net operating cost and the cash-based

budget deficit, the U.S. government’s total reported liabilities, net social

insurance commitments, and other fiscal exposures continue to grow and now

total approximately $50 trillion, representing approximately four

times the Nation’s total output ( As this long-term

fiscal imbalance continues to grow, the retirement of the “baby boom”

generation is closer to becoming a reality with the first wave of boomers

eligible for early retirement under Social Security in 2008. Given these and

other factors, it seems clear that the nation’s current fiscal path is unsustainable

and that tough choices by the President and the Congress are necessary in

order to address the nation’s large and growing long-term fiscal imbalance. Wow! I know David Walker’s been vocal lately about his concern over our economic future but it seems almost impossible to ignore the implications of his statements above. From $20 trillion in fiscal exposures in 2000 to over $50 trillion in only six years? What shall we do for an encore…shoot for $100 trillion? And how about the fact that boomers begin retiring in 2008…that always seemed to be waaaay out in the future. However, beginning January 1st we can start referring to 2008 as ‘next year’ instead of ‘some point in the future too distant to get concerned about now’. Our economic problems need to be classified as growing, imminent, and unsustainable. And let me clarify something. The $53 trillion shortfall is expressed as a ‘net present value’. That means that in order to make the shortfall disappear we’d have to have that amount of cash in the bank – today - earning interest (the GAO uses 5.7% & 5.8% as the assumed long-term rate of return). I’ll say it again - $53 trillion, in the bank, today. Heck, I don’t even know how much a trillion is let alone fifty-three of ‘em. And next year we’d have to put even more into this mythical interest bearing account simply because we didn’t collect any interest on money we didn’t put in the bank account this year. For the record, 5.7% on $53 trillion is a bit more than $3 trillion dollars so you can see how the math is working against us here. This means the deficit will swell by at least another $3 trillion plus whatever other shortfalls the government can rack up in the meantime. So call it another $4 trillion as an early guess for next year. Given how studiously our nation is avoiding this topic both in the major media outlets and during our last election cycle, I sometimes feel as if I live in a small mountain town that has decided to ignore an avalanche that has already let loose above in favor of holding the annual kindergarten ski sale. The Treasury department soft-pedaled the whole unsustainable gigantic deficit thingy in last year’s report but they have taken a quite different approach this year. From page 10 of the report: The net social

insurance responsibilities scheduled benefits in excess of estimated

revenues) indicate that those programs are on an unsustainable fiscal path

and difficult choices will be necessary in order to address their large and

growing long-term fiscal imbalance. Delay is costly and choices will be

more difficult as the retirement of the ‘baby boom’ gets closer to

becoming a reality with the first wave of boomers eligible for retirement

under Social Security in 2008 I don’t know how

that could be any clearer. The US Treasury department has issued a public

report warning that we are on an unsustainable path and that we face difficult

choices that will only become more costly the longer we

delay. Perhaps the reason

US bonds and the dollar have held up so well is that we are far from alone in

our predicament. In a recent article detailing why the UK Pound Sterling may

fall, we read this horrifying evidence: Officially, [ If we perform the

same calculations for the Now that’s

horrifying. Staggering. Whatever you wish to call it. More than four hundred

percent of Here’s what the federal shortfall means in the simplest terms. 1.

There is no way to ‘grow out of this problem’. What really jumps out

is that the Any economic

weakness will only exacerbate the problem. You should be aware that the

budgetary assumptions of the

2.

The future will be defined by lowered standards of living. As Lawrence Kotlikoff pointed out in his paper titled “Is the US Bankrupt?”

posted to the St. Louis Federal Reserve website, the insolvency of the 3.

Every government facing this position has opted to “print its

way out of trouble”. That’s an historical fact and our country shows no indications,

unfortunately, of possessing the unique brand of political courage required

to take a different route. In the simplest terms this means you & I will

face a future of uncomfortably high inflation, possibly hyperinflation if the

US dollar loses its reserve currency status somewhere along the way. In summary, I am

wondering how long we can pretend this problem does not exist. How long can

we continue to buy stocks and flip houses, forget to save, pile up debt,

import Chinese made goods, and export debt? Are these useful activities to

perform while there’s an economic avalanche bearing down upon us? Unfortunately, I am

not smart enough to know the answer. I only know that hoping a significant

and mounting problem will go away is not a winning strategy. I know that we, as a nation, owe it to ourselves to have the hard conversation about our financial future sooner rather than later. And I suspect that conversation will have to begin right here, between you and me because I cannot detect even the faintest glimmer that our current crop of leaders can distinguish between urgent and expedient. What we need is a good, old-fashioned grassroots campaign. In the meantime, I simply do not know of any way to fully protect oneself against the economic ravages resulting from poorly managed monetary and fiscal institutions. For what it’s worth, I am heavily invested in gold and silver and will remain that way until the aforementioned institutions choose to confront “what is” rather than “what’s expedient”. This could be a very long-term investment. Are you shocked? All the best. Chris © 2006 Dr. Chris Martenson, All rights reserved. ----------------------------------------------------------------------------------------------------------------------------------- |